Imagine a group of five people. They have an income distribution of $10, $20, $30, $50, and $100. Someone gets the BIG idea of everyone putting 40% of their money into a hat, and dividing the result equitably between everyone.

That means $4, $8, $12, $20, and $40 goes into the hat. That’s $84, which when divided by 5 is $16.80.

Another way of looking at this result is that the amounts paid were -$12.80, -$8.80, -$4.80, $3.20, and $23.20. The poorest three people paid negative amounts (negative taxation), meaning they received money, and the richest two people paid positive amounts (positive taxation), meaning they lost money.

If we add up the negative amounts and the positive amounts, we see that the poorest three received a total of $26.40, and the richest two lost that same amount. That is the amount of money that physically changed hands, even though everyone put money into the hat, and everyone got money from the hat.

Okay, so here’s the question: how much did it cost to make sure everyone received $16.80? Was it $16.80 multiplied by five, so $84? Or was it $26.40?

The answer is $26.40, which is 31.4% of $84. The true cost is less than one-third the false cost!

This math problem is what’s needed to understand the cost of basic income. Every time someone multiplies the number of people receiving basic income by the amount of basic income, they are saying the correct answer to the above math problem is $84, and that is entirely incorrect. They’re calculating the false cost. Such a mistake can also lead to assumptions of inflation, which are just as mistaken.

Here’s another math problem. What is the cost to provide you $12,000 in basic income if you are asked to pay $12,000 to receive it?

The answer is $0. It carries no cost. If 1,000 people fit the exact same example, the cost is 1,000 x 0, and that’s still zero. Multiplying 1 million by 0 is still 0. That’s how zero works.

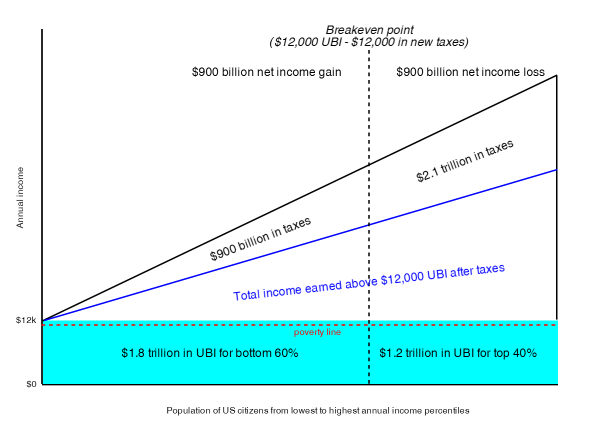

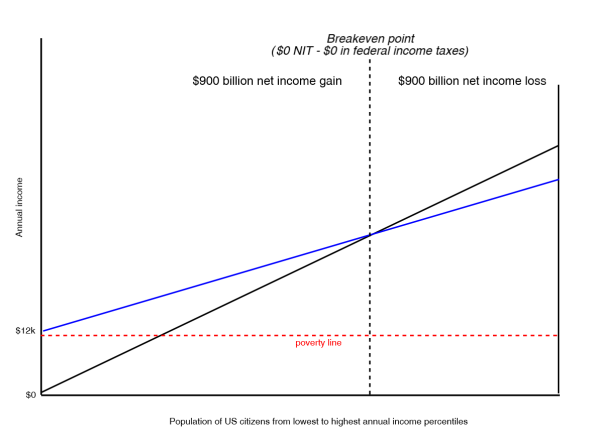

The true cost of basic income is thus the amount of money provided to net receivers, not net payers (who all cost nothing), minus the amount net receivers put into the hat.

I calculate this as around $900 billion in the U.S. (based on $12,000 per adult citizen and $4,000 per child), and this is true for both a negative income tax (with a 40% clawback rate) and a universal basic income (with a 40% flat tax).

Fun fact: Milton Friedman himself knew UBI and NIT had the same cost. So does Greg Mankiw.

A basic or citizen’s income is not an alternative to a negative income tax. It is simply another way to introduce a negative income tax if it is accompanied with a positive income tax with no exemption. A basic income of a thousand units with a 20 percent rate on earned income is equivalent to a negative income tax with an exemption of five thousand units and a 20 percent rate below and above five thousand units. — Milton Friedman

However, for a cost estimate to be even more accurate, we then need to subtract out all the programs replaced by basic income, and all the tax credits replaced by basic income. That total is in the hundreds of billions of dollars range depending on the choices we make, certainly not the $3 trillion gross range or even the $900 billion net transfer range.

Meanwhile the full costs of people not having basic income, aka the costs of not eliminating poverty…?

Yeah, that’s well over $3 trillion.

Isn’t math fun?!

With the net cost of basic income now understood, here’s how I’d fund basic income in the U.S.

Have a question about basic income? Here is a list of links that answers frequently asked questions.