Stock Drop

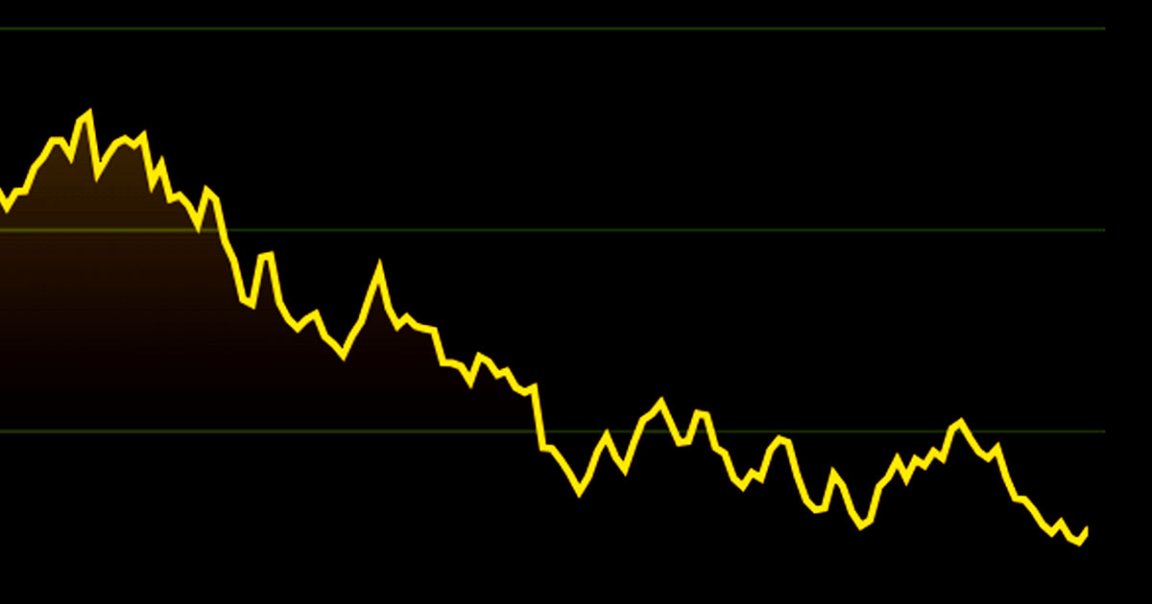

The stocks of cryptocurrency-focused companies are in a nose dive, falling as much as 60 percent this year alone, The Wall Street Journal reports, signaling a significant drop-off in interest — and a divergence between crypto companies’ stocks and the values of actual blockchain products, which are also down but not as much.

The scandal-plagued Coinbase is down a whopping 42 percent so far this year, while Riot Blockchain, a mining company, is down 34 percent over the same period, according to the WSJ. Market capitalization of publicly traded crypto companies fell from $100 billion in November, around the time the value of Bitcoin hit record highs, to a far more modest $40 billion today.

In other words, consumer interest may be waning, with trading volumes falling significantly lately. After all, companies like Coinbase, which is still the number one US crypto company by market cap, rely on transaction fees to make money.

Regulation Blues

While cryptocurrencies also aren’t having a stellar 2022, they’re not experiencing the same precipitous drop. Bitcoin is down 12 percent this year, according to WSJ, while Ether is down 19 over the same period.

So what’s actually causing crypto stocks to fall this year? It may be related to increasing talk of regulation. For instance, European Union regulators could soon require crypto firms to disclose transaction details, an effort to curb money laundering efforts.

Crypto companies, however, are now joining forces to fight these new laws.

How crypto firms will end up adopting to these new regulatory frameworks — and how that will affect their market shares long term — remains to be seen.

READ MORE: Crypto Stocks Perform Worse Than Cryptocurrencies [The Wall Street Journal]

More on crypto markets: Bored Ape Yacht Club Donates $1 Million in Crypto to Ukraine